Newman Research: ApeCoin DAO & the New AIP Proposals

Source: ApeCoin’s Twitter

Over the past weekend, many discussions have been circulating around the highly anticipated Yuga Labs x Animoca Brands Otherside land sale. As the currency powering the Otherside metaverse, ApeCoin experienced high volatility leading up to the Otherdeeds mint date due to speculation around how much APE was needed to mint each NFT and how many NFTs could be minted per KYC’ed wallet. The intensive market demand led to the burning of nearly US$180mm worth of ETH gas fees, generating largely negative sentiment and criticisms across Crypto Twitter and media platforms.

Post-mint, Yuga Labs publicly apologized on Twitter and promised to refund gas fees for unsuccessful minters whose transactions failed due to the gas war. Along with the remedy, the company proposed the need for migrating to its chain in order to properly scale and encouraged the ApeDAO “to start thinking in this direction.” Whether the chaos resulting from the sale were due to flaws in the Ethereum blockchain is arguable, however it is apparent that ApeCoin has always been the center of discussions due to its connection with the premium BAYC NFT.

In the same weekend, leading NFT marketplace OpenSea announced it would be accepting ApeCoin (APE) payments on its platform, alongside other tokens like ETH/WETH, SOL, USDC, and DAI. As of January 2022, BAYC trading volume surpassed US$1bn. APE gained its recognition and social currency as the token linked to the BAYC ecosystem. As long as BAYC continues to maintain its relevance, we foresee that ApeCoin utility and adoption will only increase in the NFT/metaverse space, potentially allowing it to become one of the most influential tokens in Web3.

II. The Launch of ApeCoin

The ApeCoin community governs itself through the ApeDAO which makes decisions based on community-driven Ape Improvement Proposal or AIPs that are voted on via Snapshot. As part of its launch, ApeCoin announced 5 initial proposals, two of which were drafted by Animoca Brands, AIP-4 and AIP-5. While the first three proposals were passed, AIP-4 and AIP-5 received an overwhelming percentage of ‘against’ votes from the community and therefore were not executed. During and after the vote, discussions within the ApeCoin community took place in their forum, across Twitter and in a number of places both on and offline. The essential feedback was that overall the framework was adequate, but lacked the key element of caps.

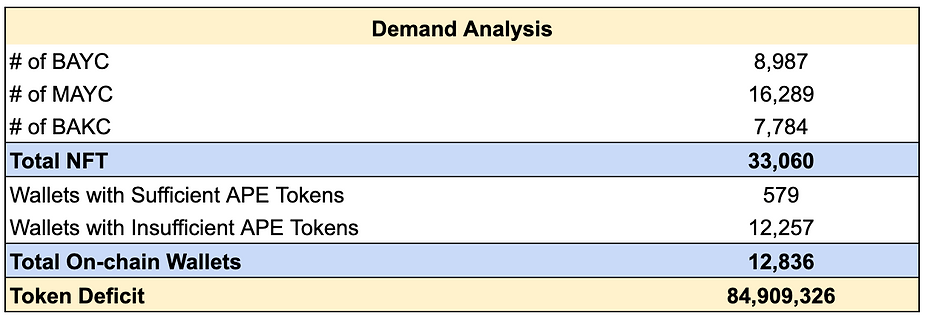

Notes:

- Demand analysis is based on the number of NFTs and ApeCoin that all claimed NFT holders had in their wallets as of 3 May 2022.

- Assumption is made that all claimed NFT holders participate in the staking program

- The above data does not include any tokens stored at CEX and cold wallets

V. Effects on General NFT Holders

Utility, floor price, and demand are constant conversations that fuel all NFT communities, including the BAYC ecosystem. The introduction of ApeCoin has so far given BAYC-related NFTs further holder utility in the form of airdrops and free land claims, however there is still much debate as to how much these holders can and should benefit from ApeCoin in the future. According to the proposed staking mechanism, a BAYC-related NFT only acts as a “key” to the staking pool and only ApeCoin can be staked. If a holder decides to sell their NFT, they must consider unstaking their ApeCoin prior to sale. If APE remains staked at the point of sale, tokens will automatically be transferred in the purchase.