When it comes to NFT marketplaces, OpenSea currently dominates market share, but there is room for competition. Often misnamed “BrokenSea” on Twitter in user complaints, flaws with the leading NFT marketplace leave space for new entrants and competitors like LooksRare to gain traction if user concerns and needs can be better addressed.

Single-focus NFT marketplaces exist to target niche audiences, however they run into a transactions and trading volume ceiling given limited demand. Some examples include SuperRare and Foundation which cater to high-end digital art. If these platforms do not continue to evolve and grow with their community or reach new audiences, we may see a tapering in activity and trading volume as in the case of NBA Top Shot, the Flow-based closed marketplace which specifically serves basketball fans and those who collect sports memorabilia and moments.

Major centralized exchanges (CEXs) have also entered the chat. Looking to tap into the NFT market and capitalize on their large user bases, CEXs like Binance, OKX, and FTX have expanded their offerings to include NFT verticals. The top exchange to generate noise in the NFT space has been Coinbase, despite the delayed launch of its much anticipated NFT marketplace, which is now available in limited beta as of 20 April 2022. The exchange experienced a slow start in its first week of transactions, however we believe CEXs might still have a place in NFT adoption among new crypto users.

In the meantime, OpenSea continues to preserve its monopoly through expansion to support Polygon, Klatyn, and most recently Solana-based NFTs alongside digital assets on the Ethereum network. Prior to OpenSea’s cross-chain integration, we also saw blockchain-specific platforms emerge including Magic Eden for Solana-based NFTs and Objkt for Tezos-based projects. Moving forward we expect to see multi-chain support become the standard for all NFT marketplaces as competition intensifies.

OpenSea currently outpaces all marketplaces and healthy market competition is needed to push all platforms to continually improve their responsibility to users and range of offerings. Some other competitive advantages to look out for in NFT marketplaces include improved UI/UX, lower platform fees, hybrid payment methods, user rewards, and responsiveness to community feedback.

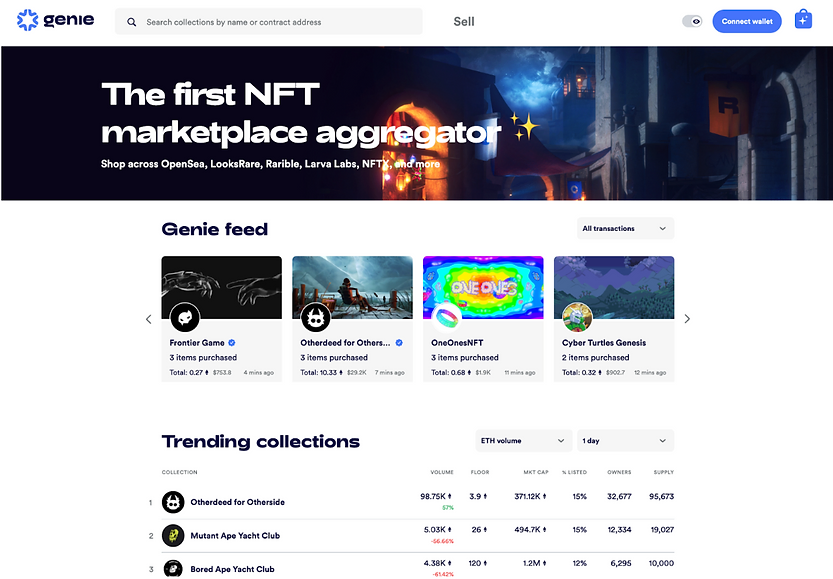

2. Streamlined Trading through NFT Aggregators

While the NFT marketplace scene seems to be getting more crowded, the demand for NFT marketplace aggregators also appears to be getting higher. NFT aggregators enable users to gain full coverage and transparency with a single interface and browse multiple collections simultaneously. Users can trade NFTs in bulk without checking across various venues and, more importantly, save potential gas fees up to 40%.