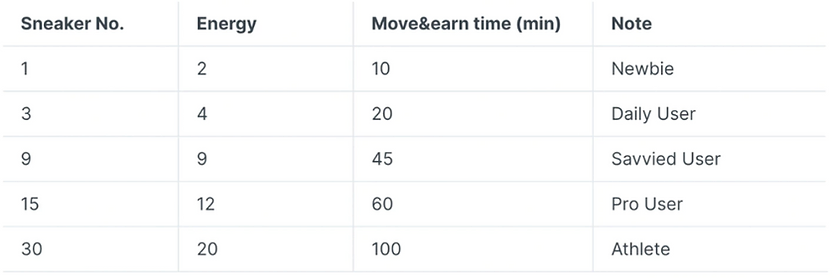

A basic walker will earn 5 GST per energy. At the time of writing, the price of GST is $0.2, that’s $1.0 per energy. With two energy per basic sneaker plus the cost of about 3.5 SOL, approximately $100, users could earn the total cost back in roughly 40-50 days. The assumption is based on the users selling the GST reward as soon as they earn it, instead of spending on upgrades. On top of that, in-game token price fluctuations and gambling mechanisms (e.g. unboxing and gems) consume a lot of users’ funds. The reinvestment rate of users is close to 100%, as most users will invest more money after using entry-level NFTs for a while; therefore, the real payback period is higher than 40-50 days.

The supply of GST is infinite. We believe that’s not a token that is designed for users to hold as a long-term investment. In other words, a typical user will only keep enough GST for in-game upgrades/minting and sell the rest. We notice every GST use case that consume users’ fund, will lead to an increment of GST earnings for users, which could spiral into a problem, or worse, the token could crash quickly without any effective burning mechanism in place.

GMT Utility and Tokenomics

GMT is the governance and value token for the STEPN ecosystem. As opposed to GST, GMT is designed to be deflationary with a limited supply of 6,000,000,000. The total release of GMT will halve every three years.

Users will be able to earn GMT when they move with a level 30 NFT and participates in-game activities. In addition, when the GST price is higher than $2, GMT will be required for shoe minting. According to the team, features like staking will bring extra utility to the GMT token in the future.

Sneaker Economy

The economic structure of STEPN sneakers is similar to that of Axie Infinity. In Axie Infinity, players burn in-game tokens to breed Axies. In STEPN, we have shoe minting. Both games rely on new players to keep the game profitable for existing players. If the demand for new sneakers falls, their prices on the secondary market will follow. Let users mint new NFTs forever is unrealistic and expect them to hold their value. For STEPN to be sustainable, the sneaker breeding problem needs to be addressed by introducing some form of burning mechanism, so those excess sneakers will be able to maintain their value.

Move-to-earn or Ponzinomics?

The M2E Doom Cycle

A Ponzi scheme is an investment fraud that pays existing investors with funds collected from new investors. In STEPN’s case, new sneaker buyers and minters inject fresh capital into the system. This action implies more GST are burnt, which increases GST price and, therefore, higher return for existing users. To maintain a reasonable value of in-game rewards, GST needs to be burned up to the rate of GST rewards being issued. So, what could potentially trigger a STEPN’s death spiral?

- A decline in user growth, reduction in new capital inflow, and more users selling their shoes to extract earnings instead of minting.

- Too many users minting new sneakers, not enough new demand to sustain the gameplay, and sneaker prices fall.

- More and more existing users become advanced players with high-level sneakers, the treasury cannot support the corresponding high earnings, GST price fall.

In short, once the ecosystem reaches its user peak, the M2E doom cycle will be in full spin. Existing users likely will panic sell sneakers with floor price dropping, within a month’s time, we have seen STEPN sneakers’ floor price drop from 13.9 SOL to less than 4 SOL. The increasing GST circulation will create a dumping pressure, hence a fall in GST price. Since sneaker prices are correlated to GST price, this will further lower sneaker prices. At that point, potential users will be reluctant to enter due to the low returns and prolonged payback period.

Sustaining the Ponzinomics

Since its beta launch in Dec 2020, the team has implemented several measures to ensure a healthy growth in terms of users and token price. For instance, STEPN introduced a GMT buyback and burn mechanism to limit GMT’s supply, the 26M profit generated in Q1 2022 from NFT marketplace trading and royalty fees were used to buy back the tokens from the secondary market, and burn them on-chain. The team has shown its ability to pivot during price volatility and implemented suitable price measures in the past. For example, STEPN introduced a week-long double GST earning incentives when the GST price is extremely low. When GST price is too high, price cooling measures such as dynamic minting (i.e. the cheaper the GST, the more GST is needed) were added to switch up the minting cost by reducing the amount of GST required.

The larger the STEPN ecosystem is, the more challenging it becomes to maintain its sustainability and attract enough daily new capital inflow to endure the gameplay. This is because user growth implies corresponding reward growth on an exponential scale. For this reason, the project has been limiting its growth and strives to gain users organically. New entrants can only enter the ecosystem with invite-only activation code.

As you can see, the system can easily insert randomness to users’ earnings, which makes GMT and GST buying and dumping pressure unpredictable. In addition, there are more and more initiatives and gameplay alternation that the team could introduce to sustain the project, such as staking, sneaker burning, or fundraising for treasury.

Conclusion

Previous play-to-earn (P2E) projects have demonstrated that STEPN’s current model is not sustainable. To most people, the crash of STEPN Is inevitable. That being said, the STEPN team has shown exceptional attitude in proving that they are here to stay, from introducing dynamic minting, initiating buy back and burn mechanism, to implementing price control measures. Can the STEPN team solve the good old P2E hyperinflation issue? Can STEPN evolve its economic design without relying on new capital inflow? Only time will tell.