Introduction

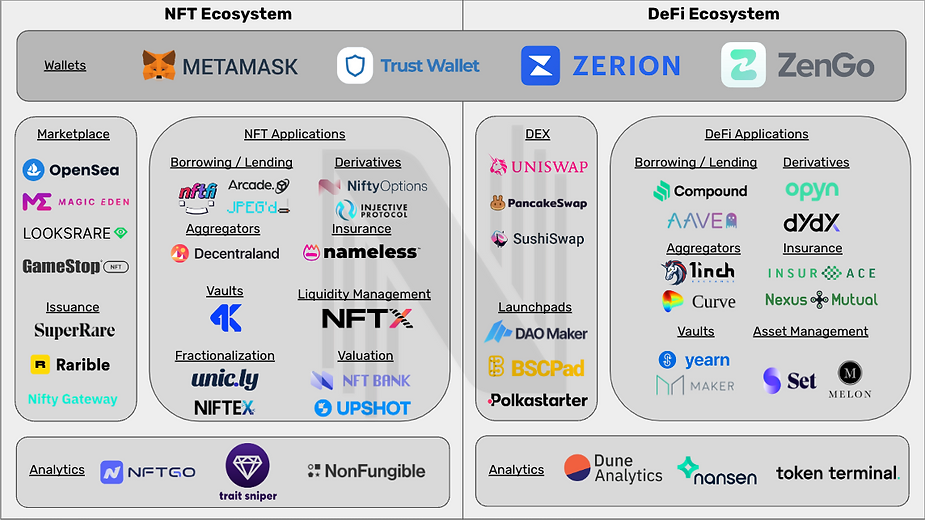

Capital inefficiency and price discovery are the two main hurdles that create illiquidity for NFT assets. Users can only recently deposit their previously illiquid assets into the DeFi ecosystem to generate income and provide liquidity. Today, we will look into the state of NFT lending, which is a crucial part of the financialization of NFT, and the solution to the illiquidity problems of NFTs. We will start by illustrating two major types of lending models and then elaborate on our prediction within this space of the crossover between NFT and DeFi.

Traditionally, an illiquid asset refers to an asset that cannot be easily sold or traded without a significant discount. Real estate, collectible automobiles, antiques, and art collectibles are some common examples of illiquid assets. Trading of these assets usually takes months or potentially longer to find a buyer. For this reason, since the 1970s, intermediaries such as banks and auction houses have provided liquidity to an exclusive audience so people can extract value from their illiquid assets by using them as loan collateral.

Today, non-fungible tokens (NFTs), an emerging asset in the crypto space, are facing similar issues. NFTs consist of digital data stored on the blockchain, representing property rights, uniqueness, and a level of illiquidity comparable to fine art and collectibles. While we can sell fungible tokens like BTC and ETH almost instantly in the market, it takes much longer to sell NFTs in any secondary market. As a result, NFT lending protocols have emerged as a liquidity solution for this digital asset.

Currently in an early development stage, NFT lending has plenty of room for growth. As of 14 July 2022, the total NFT market is worth $22.98 billion, reaching a provisional peak of $35 billion in January 2022. Blue-chip NFT collections, which most lending protocols now support, represent 30% of the market. With the expectation that more collections will be approved in the near future and more DAOs exploring the concept, the lending sector is anticipated to grow significantly larger and play an increasingly important role in the broader NFT landscape.

What is NFT Lending?

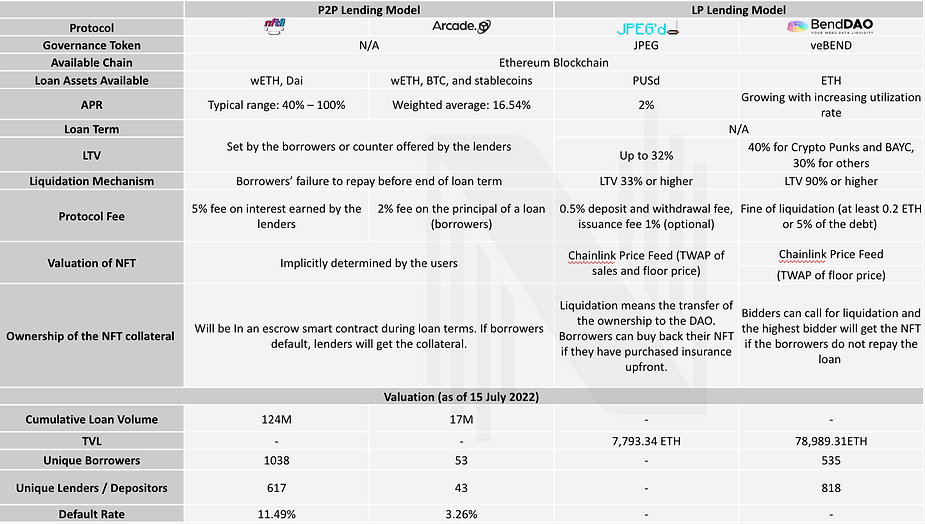

Peer-to-Peer (P2P) Lending Model

Similar to DeFi lending, there are also a few lending models that work well with NFTs, one being peer-to-peer (P2P) NFT lending.

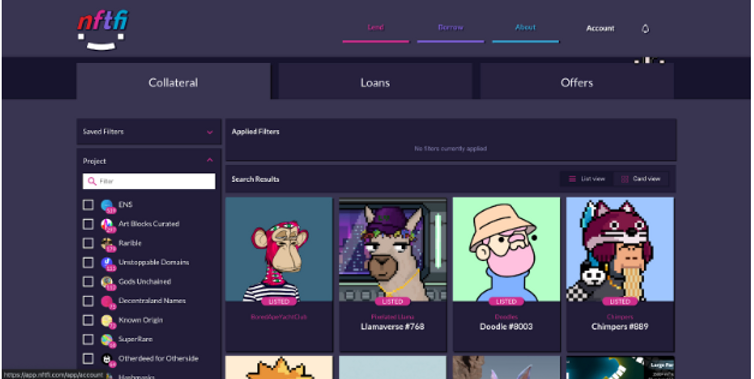

NFTfi

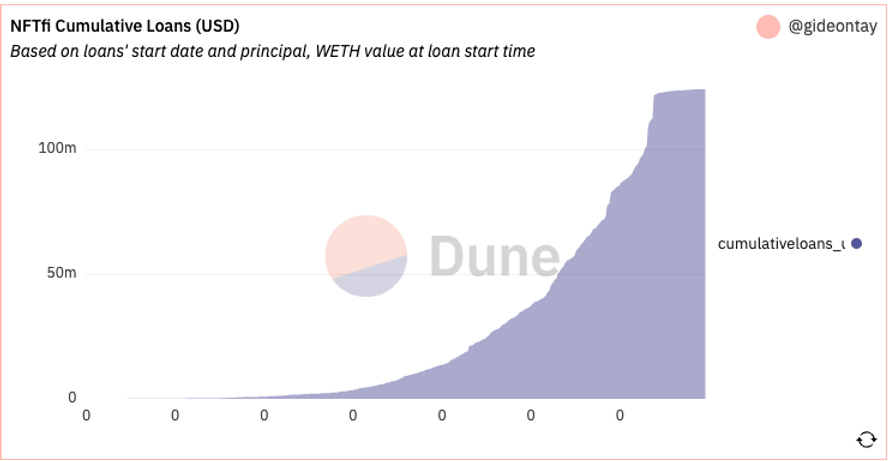

NFTfi is a P2P NFT lending platform that allows borrowers to collateralize their NFTs to borrow loans while lenders earn interest by lending out their NFTs. It is the leading NFT lending protocol by volume. As of 13 July 2022, it has facilitated over $123 million.